Equity Investing

Overview

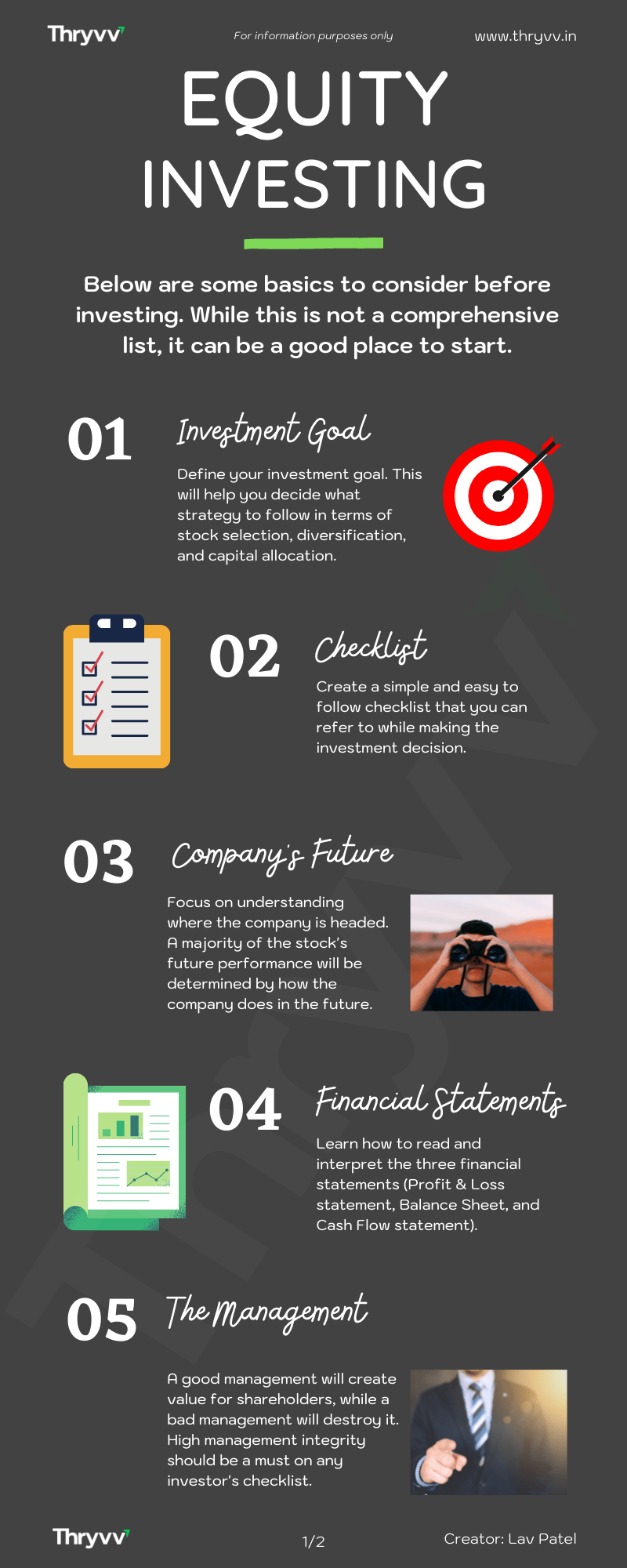

Below are some basics to consider before investing. While this is not a comprehensive list, it can be a good place to start.

- Investment Goal – Define your investment goal. This will help you decide what strategy to follow in terms of stock selection, diversification, and capital allocation. To read more, click here.

- Checklist – Create a simple and easy-to-follow checklist that you can refer to while making the investment decision. To read more, click here.

- Company’s Future – Focus on understanding where the company is headed. A majority of the stock’s future performance will be determined by how the company does in the future. To read more, click here.

- Financial Statements – Learn how to read and interpret the three financial statements (Profit & Loss Statement, Balance Sheet, and Cash Flow statement). To read more, click here.

- The Management – A good management will create value for shareholders, while bad management will destroy it. High management integrity should be a must on any investor’s checklist. To read more, click here.

- Valuation – Learn about various valuation methods and when to use them. Eg: DCF calculations, P/E ratio, P/B ratio, P/S, EV/EBITDA, etc. To read more, click here.

- Portfolio Allocation – Finding the right stock for your portfolio is important, but allocating the right amount of money to it is equally important if not more. Learn and understand the benefits and risks of diversification. To read more, click here.

- Timeframe – Know the game you are playing. Market sentiments influence the stock price movement heavily in the short term, whereas the underlying business fundamentals influence the stock price movement over the long run. To read more, click here.

- Know yourself & your style – Know where your edge is and know where your Achilles Heel is. Gauge your emotional intelligence. Everyone has their own individual investing style that suits & works for them. Understand your style, develop it, and follow it. To read more, click here.

- Journaling – Always write down the reasons for making an investment decision and periodically check if those reasons are still true. Keep an eagle eye on how the company is doing. This will help with holding onto winners and getting rid of losers early. To read more, click here.

Warning: Undefined variable $post_id in /var/www/html/wp-content/themes/thryvv-child/template-parts/author-bio.php on line 4

Extra Information

Disclaimer: The information provided here is for education purposes only. It should not be taken as investment advice. Please consult your investment advisor before making investment decisions.